SOLID WASTE MANAGEMENT

- As of now, Delhi's solid waste management (SWM) system faces significant challenges. According to the 2011 Census, the population of New Delhi was approximately 1.7 crore, expected to reach around 2.32 crore in 2024.

- With an average per capita waste generation of 0.6 kg/day, the city generates roughly 13,000 tonnes per day (TPD) of waste, equivalent to about 1,400 truckloads, totalling approximately 42 lakh tonnes annually.

- With the projected population increase to 2.85 crore by 2031, waste generation could surge to 17,000 TPD.

- About 90% of the waste generated in Delhi is collected by the three municipal corporations: the Municipal Corporation of Delhi (MCD), Delhi Cantonment Board, and the New Delhi Municipal Corporation.

- Typically, 50-55% of the waste in Indian cities is biodegradable wet waste, 35% is non-biodegradable wet waste, and 10% is inert.

- Consequently, Delhi generates around 7,000 TPD of wet waste, 4,800 TPD of dry waste, and 2,000 TPD of inert waste.

6. Decentralization of Waste Processing

- Given the challenges associated with identifying large land parcels in Delhi, collaboration with neighbouring states becomes essential for setting up composting plants. Moreover, there exists a market for organic compost produced from wet waste in states like Haryana and Uttar Pradesh, highlighting the potential for cross-border partnerships.

- Delhi, with its 272 wards, can draw inspiration from states like Tamil Nadu and Kerala, which have established decentralised Micro-Composting Centres (MCCs) at the ward level, each with a capacity of five TPD. These MCCs have the potential to manage approximately 20% of the city's wet waste. Similarly, Bengaluru has implemented ward-level Dry Waste Collection Centres (DWCCs) with a capacity of 2 TPD each, capable of handling about 10% of the dry waste.

- To effectively manage waste, Delhi's SWM system should integrate decentralized options for both wet and dry waste. These initiatives should be complemented by larger processing facilities to ensure all generated waste undergoes scientific processing. The city must maximize the utilization of existing processing facilities while simultaneously constructing new ones to prevent any waste from remaining untreated.

- Furthermore, urban local bodies should actively seek to learn from best practices implemented in other Indian cities and abroad regarding efficient SWM processing. By adopting such approaches, Delhi can enhance its waste management infrastructure and address its waste challenges more effectively.

|

For Prelims: Solid Waste Management, Environment Pollution

For Mains:

1. How can waste-to-energy plants contribute to sustainable waste management in India? Evaluate the potential benefits and drawbacks of this approach. (250 Words)

|

|

Previous Year Questions

1. In India, ‘extend producer responsibility’ was introduced as an important feature in which of the following? (UPSC CSE 2019) (a) The Bio-medical Waste (Management and Handling) Rules, 1998

(b) The Recycled Plastic (Manufacturing and Usage) Rules, 1999

(c) The e-Waste (Management and Handling) Rules, 2011

(d) The Food Safety and Standard Regulations, 2011

Answer: C

|

Source: The Hindu

VOLATILITY INDEX

- Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, security, or market over a specific period. It measures the rate at which the price of an asset moves up and down, indicating the level of uncertainty or risk associated with that asset.

- In financial markets, volatility is often measured using statistical metrics such as standard deviation or variance. High volatility implies that the price of the asset can change dramatically over a short period, indicating higher risk, while low volatility suggests more stable price movements and lower risk.

- Volatility can result from various factors such as market sentiment, economic conditions, geopolitical events, and changes in supply and demand dynamics. Traders and investors closely monitor volatility levels to assess risk, make investment decisions, and implement risk management strategies.

The India VIX Index is a crucial indicator for investors and traders in the Indian stock market because it helps them gauge the market's expected volatility over the next 30 days.

Risk Management

Trading Strategies

Market Sentiment

Benchmarking Performance

The VIX Index, also known as the volatility index or fear gauge, can be used for trading in several ways.

- Traders can use VIX futures or options to hedge against portfolio risk. When expecting increased market volatility, traders can purchase VIX options or futures contracts as a hedge against potential losses in their equity positions.

- Some traders actively trade VIX futures or options to capitalize on changes in market volatility. They may buy VIX contracts when they expect volatility to increase and sell when they expect it to decrease.

- Traders can use the VIX to make directional bets on the market. For example, if the VIX is at historically low levels, indicating low volatility and potentially complacent market sentiment, traders may anticipate a market correction and take short positions in equities or equity indices.

- Extreme levels of the VIX can act as contrarian indicators. When the VIX reaches extremely high levels, indicating widespread fear and panic in the market, it may signal a potential buying opportunity for contrarian traders. Conversely, when the VIX reaches extremely low levels, indicating high levels of complacency, it may signal a potential market top.

- VIX can be used to assess the pricing of options. Options traders can compare the implied volatility of individual stocks or indices to the VIX to identify potential mispricings and trading opportunities.

- VIX can be used as a risk management tool to adjust position sizes or portfolio allocations based on expected changes in market volatility. Traders may reduce exposure to riskier assets or increase hedges when the VIX is expected to rise.

The relationship between the VIX Index and economic stability is indirect but significant, as the VIX primarily reflects market volatility and investor sentiment rather than underlying economic conditions. However, there are several ways in which the VIX can provide insights into economic stability.

- High levels of volatility, as indicated by a rising VIX, can reflect uncertainty and a lack of confidence in the economy and financial markets. Sharp increases in the VIX may coincide with periods of economic instability, such as recessions or financial crises, as investors react to negative economic indicators or geopolitical events.

- Elevated levels of volatility can indicate stress in financial markets, which may spill over into the broader economy. A persistently high VIX may signal systemic risks and potential disruptions to economic activity, as investors become more risk-averse and market liquidity dries up.

- Changes in the VIX can influence investor risk appetite and investment behaviour, which in turn can affect economic stability. High volatility may lead to reduced investment and capital expenditure by businesses, impacting economic growth. Similarly, volatile markets can discourage consumer spending and confidence, affecting overall economic activity.

- Central banks and policymakers may monitor the VIX as part of their assessment of economic stability and financial market conditions. Sharp increases in volatility may prompt central banks to intervene with monetary policy measures to stabilize markets and support economic growth.

- Volatility spikes in one market or asset class can trigger contagion effects, spreading to other markets and causing broader economic disruptions. For example, a sharp increase in equity market volatility may lead to sell-offs in other asset classes, such as bonds or commodities, affecting investor sentiment and economic stability.

Foreign Portfolio Investors (FPIs), also known as Foreign Institutional Investors (FIIs) in some countries, are entities such as mutual funds, pension funds, hedge funds, insurance companies, and sovereign wealth funds that invest in the financial markets of a country other than their own. FPIs typically invest in a diversified portfolio of financial assets, including stocks, bonds, money market instruments, and other securities.

The key characteristics of foreign portfolio investors

- FPIs encompass a wide range of institutional investors from foreign countries. They may include both public and private sector entities, as well as individuals investing through pooled investment vehicles like mutual funds.

- FPIs invest in financial markets to earn returns on their investments. They may have different investment strategies and mandates, ranging from long-term value investing to short-term trading.

- FPIs often maintain diversified portfolios across different asset classes, sectors, and geographic regions to manage risk and enhance returns. They may allocate their investments based on factors such as market conditions, economic outlook, and risk appetite.

- FPIs can have a significant impact on the financial markets of the countries in which they invest. Their buying and selling activities can affect asset prices, market liquidity, and investor sentiment.

- Most countries have specific regulations and guidelines governing the participation of FPIs in their financial markets. These regulations often include registration requirements, investment limits, disclosure obligations, and restrictions on certain sectors or industries.

- FPIs play a vital role in global capital markets by providing liquidity, diversification opportunities, and capital allocation efficiency. They contribute to the development and integration of financial markets and facilitate cross-border investment flows.

7. What are NSE and BSE?

NSE and BSE are the two primary stock exchanges in India.

National Stock Exchange (NSE)

- The National Stock Exchange of India Ltd. (NSE) is the leading stock exchange in India in terms of trading volumes and turnover.

- It was established in 1992 and is headquartered in Mumbai, Maharashtra.

- NSE provides a fully automated electronic trading platform known as the National Exchange for Automated Trading (NEAT), which facilitates trading in equities, derivatives, debt instruments, and currency futures.

- It offers a wide range of financial products, including equities, equity derivatives (futures and options), currency derivatives, debt instruments, mutual funds, and exchange-traded funds (ETFs).

- Nifty 50, Nifty Bank, Nifty IT, and other indices are popular benchmarks managed by NSE.

- NSE has a reputation for transparency, efficiency, and technological innovation in the Indian capital markets.

Bombay Stock Exchange (BSE)

- The Bombay Stock Exchange Ltd. (BSE) is one of the oldest stock exchanges in Asia, established in 1875.

- It is headquartered in Mumbai, Maharashtra, and is also known as BSE Limited.

- BSE provides a platform for trading in equities, derivatives, debt instruments, mutual funds, and currency derivatives.

- Its flagship index, the BSE Sensex, is one of the most widely tracked benchmark indices in India, comprising 30 large and well-established companies listed on the exchange.

- BSE is known for its historic significance, having played a crucial role in the development of the Indian capital markets over the years.

- While BSE historically operated as an open-outcry trading floor, it has transitioned to electronic trading systems, including the BOLT (BSE OnLine Trading) platform, to facilitate faster and more efficient trading.

Both NSE and BSE play key roles in the Indian financial system, providing platforms for companies to raise capital, investors to trade securities, and regulators to oversee the functioning of the capital markets. They contribute to the liquidity, efficiency, and transparency of India's stock market ecosystem.

8. Way Forward

By understanding the VIX and its implications, investors, policymakers, and the general public can be better equipped to navigate market volatility and make informed decisions in a dynamic financial landscape.

|

For Prelims: Volatility Index, Bombay Stock Exchange, National Stock Exchange, Foreign Portfolio Investors, FDI

For Mains:

1. Who are Foreign Portfolio Investors (FPIs) and their impact on the Indian stock market? How do FPIs influence market volatility, and what regulations are in place to manage their activities? (250 Words)

2. Briefly explain the role and function of the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) in the Indian financial system. (250 Words)

|

|

Previous Year Questions

1. In the context of finance, the term "beta" refers to (UPSC 2023)

a. the process of simultaneous buying and selling of an asset from different platforms

b. an investment strategy of a portfolio manager to balance risk versus reward

c. a type of systemic risk that arises where perfect hedging is not possible

d. a numeric value that measures the fluctuations of a stock to changes in the overall stock market

2. The volatility in the Indian share market is due to - (RPSC RAS 2013)

(A) Inflow and outflow of foreign funds

(B) Fluctuations in foreign capital markets

(C) Changes in the monetary policy

Which of the above-mentioned causes are correct?

1. (A) and (B) 2. (A) and (C) 3. (A), (B) and (C) 4. (B) and (C)

Answer: 3

3. Bombay Stock Exchange is the ________ stock exchange of Asia. (SSC MTS 2021)

A. first B. second C. fourth D. third

Answer: A

4. ‘SENSEX’ is the popular Index of Bombay Stock Exchange (BSE). It is measured on the basis of how many blue chip companies listed in BSE? (UPPSC Combined State Exam General Studies 2021)

A. 20 B. 30 C. 25 D. 10

Answer: B

5. Which of the following is issued by registered foreign portfolio investors to overseas investors who want to be part of the Indian stock market without registering themselves directly? (upsc 2019)

(a) Certificate of Deposit (b) Commercial Paper (c) Promissory Note (d) Participatory Note Answers: 1-D, 2-3, 3-A, 4-B, 5-D |

NISAR

1. Context

2. Key Points

- The SUV-size satellite will be shipped to India in a special cargo container flight later this month for a possible launch in 2024 from Satish Dhawan Space Centre in Andhra Pradesh.

- It is one step closer to fulfilling the immense scientific potential NASA and ISRO envisioned for NISAR joined forces more than eight years ago.

- This mission will be a powerful demonstration of the capability of radar as a science tool and help us study Earth's dynamic land and ice surfaces in greater detail than ever before.

3. About NISAR

- NISAR has been built by space agencies of the US and India under a partnership agreement signed in 2014.

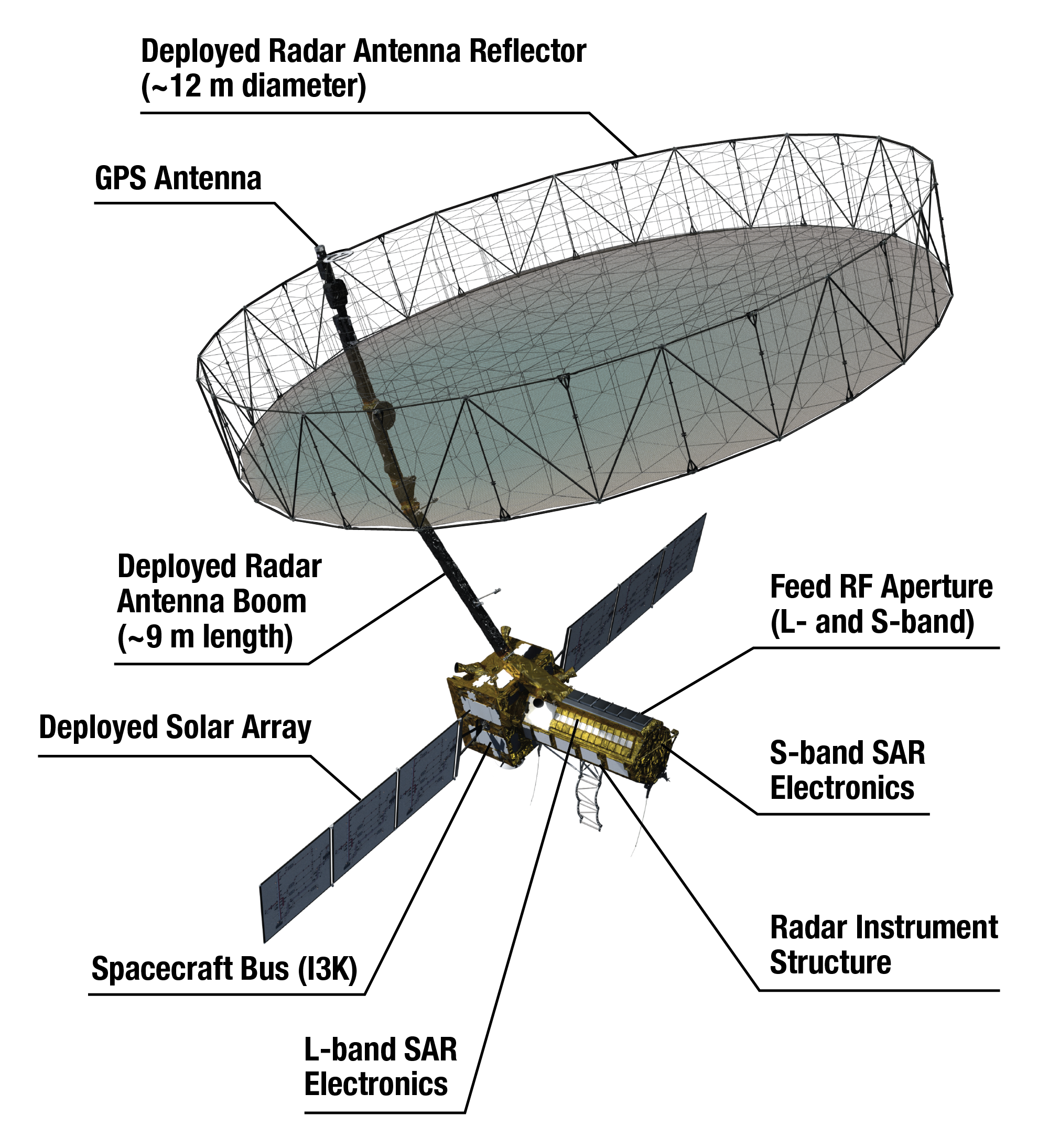

- The 2, 800 kilograms satellite consists of both L-band and S-band synthetic aperture radar (SAR) instruments, making it a dual-frequency imaging radar satellite.

- While NASA has provided the L-band radar, GPS, a high-capacity solid-state recorder to store data and a payload data subsystem, ISRO has provided the S-band radar, the GSLV launch system and spacecraft.

|

Another important component of the satellite is its large 39-foot stationary antenna reflector.

Made of a gold-plated wire mesh, the reflector will be used to focus " the radar signals emitted and received by the upward-facing feed on the instrument structure".

|

4. The Mission

- Once launched into space, NISAR will observe subtle changes in Earth's surfaces, helping researchers better understand the causes and consequences of such phenomena.

- It will spot warning signs of natural disasters, such as volcanic eruptions, earthquakes and landslides.

- The satellite will also measure groundwater levels, track flow rates of glaciers and ice sheets and monitor the planet's forest and agricultural regions, which can improve our understanding of carbon exchange.

|

By using synthetic aperture radar (SAR), NISAR will produce high-resolution images.

SAR is capable of penetrating clouds and can collect data day and night regardless of the weather conditions. The instrument's imaging Swath the width of the strip of data collected along the length of the orbit track is greater than 150 miles (240 kilometres), which allows it to image the entire Earth in 12 days. |

- NISAR is expected to be launched in January 2024 from Satish Dhawan Space Centre into a near-polar orbit.

- The satellite will operate for a minimum of three years.

- NASA requires the L-band radar for its global science operations for at least three years.

- Meanwhile, ISRO will utilise the S-band radar for a minimum of five years.

For Prelims & Mains

|

For Prelims: NISAR (NASA-ISRO Synthetic Aperture Radar), Satish Dhawan Space Centre, Earth-observation satellite, Jet Propulsion Laboratory, L-band and S-band synthetic aperture radar, GPS, GSLV launch system and spacecraft,

For Mains:

1. What is NISAR and Explain its benefits (250 Words)

|

TUBERCULOSIS

1. Context

2. About Tuberculosis

- Tuberculosis (TB) is an infectious disease caused by Mycobacterium tuberculosis.

- It commonly affects the lungs, but can also affect other parts of the body.

- It is a treatable and curable disease.

- TB is spread from person to person through the air. When people with lung TB cough, sneeze, or spit, they propel the TB germs into the air.

- Common symptoms of active lung TB are cough with sputum and blood at times, chest pains, weakness weight loss, fever, and night sweats.

- Bacille Calmette-Guerin (BCG) is a vaccine for TB disease.

3. How many TB cases are detected each year?

- Although India continues to be the largest contributor to global TB cases, there has been a decline in the number of cases in 2021.

- Reporting of TB cases also improved in 2021 although it didn’t reach the pre-pandemic levels, it bounced back from the lows seen during the first year of the pandemic, according to the Global TB Report 2022.

- The incidence of TB new cases detected throughout the year was reduced by 18% in 2021 over the 2015 baseline, dropping to 210 cases per lakh population as compared to 256 cases per lakh population.

- The incidence of drug-resistant TB also went down by 20% during the period from 1.49 lakh cases in 2015 to 1.19 lakh cases in 2021.

India accounts for 28% of all TB cases in the world, according to the Global TB Report 2022.

4. What is India’s elimination target?

- Although the elimination of Tuberculosis is one of the sustainable development targets to be achieved by 2030 by the world, India has set a target of 2025.

- The national strategic plan 2017-2025 sets the target of India reporting no more than 44 new TB cases or 65 total cases per lakh population by 2025.

- The estimated TB incidence for the year 2021 stood at 210 per lakh population.

- Achieving this target is a big task as the plan had envisaged an incidence of only 77 cases per lakh population by 2023.

- The programme also aims to reduce the mortality to 3 deaths per lakh population by 2025. The estimated TB mortality for the year 2020 stood at 37 per lakh population.

- The plan also aims to reduce catastrophic costs for the affected family to zero.

- However, the report states that 7 to 32 percent of those with drug-sensitive TB, and 68 percent with drug-resistant TB experienced catastrophic costs.

- The goals are in line with the World Health Organisation’s End TB strategy which calls for an 80% reduction in the number of new cases, a 90% reduction in mortality, and zero catastrophic cost by 2030.

5. What is being done to try to achieve this target?

- To achieve the TB elimination target of 2025, the government has taken several steps including looking for cases actively among vulnerable and co-morbid populations, screening for it at health and wellness centers, and calling on the private sector to notify all TB cases.

- An online Ni-kshay portal has been set up to track the notified TB cases.

- The pandemic has led to improved access to more accurate molecular diagnostic tests like CB-NAAT and TureNat which were also used to test for Covid-19.

- At present, there are 4,760 molecular diagnostic machines available, covering all districts of the country.

- In addition, 79 line probe assay laboratories and 96 liquid culture testing laboratories have been set up for the diagnosis of multi and extremely drug-resistant TB.

- The government has also implemented a universal drug susceptibility test, meaning that antibiotic susceptibility of the mycobacterium is determined for all newly diagnosed cases.

- Earlier, the patients were started on first-line treatment and were tested for drug resistance only if the therapy did not work. Conducting a drug susceptibility test at the outset ensures that the patients are given antibiotics that will work for them from the get-go.

- Last year, the government also launched a community engagement program where Ni-kshay Mitras can adopt TB patients and provide them with monthly nutritional support. So far 71,460 Ni-kshay Mitras have adopted about 10 lakh TB patients under the programme.

6. Improvements in Treatments Protocols

- Newer drugs such as Bedaquiline and Delamanid for the treatment of drug-resistant TB have been included in the government’s basket of drugs provided for free to TB patients.

- These oral drugs can replace the injectable kanamycin that was associated with serious side effects like kidney problems and deafness.

- These new drugs have also been included in the new National List of Essential Medicines that gives the government power to regulate their market price as well.

- Researchers have also been studying shorter three- and four-month courses of antitubercular drugs, instead of the existing six-month therapy.

- Anti-tubercular drugs have to be taken for six months to over two years depending on the susceptibility of the mycobacterium.

- Long duration of treatment results in people dropping out in between, increasing their likelihood of them developing drug-resistant infections later.

7. Newer Vaccines in the Pipeline

- Nearly 100 years after the existing BCG vaccine was developed, researchers are on the lookout for newer ways of preventing tuberculosis infection.

- The BCG vaccine uses a weakened form of TB bacteria to train the immune system.

Although it can protect against severe forms of TB like the ones in the brain, the protection is not very good against the most common form of TB in the lungs. - It offers limited protection to adults, it doesn’t prevent people from getting the infection or re-activation of a latent infection.

- Trails are underway to test the effectiveness of a vaccine called Immuvac, which was initially developed to prevent leprosy, preventing TB.

- The vaccine developed using mycobacterium indicus pranii has antigens the portions of a pathogen against which antibodies are developed similar to those of leprosy and TB bacteria.

- Researchers are also testing the vaccine candidate called VPM1002, which is a recombinant form of the BCG vaccine modified to express the TB antigens better.

- This results in better training of the immune system and protection against TB.

Researchers are also studying whether the existing BCG vaccine booster shot should be given to household contacts of a person with active tuberculosis.

Previous year Question

|

1. Tuberculosis immunization was developed by (TNPSC 2011)

A. Albert Calmette

B. Paul Ehrlich

C. Robert Koch

D. Louis Pasteur

Answer: A

|

For Prelims & Mains

|

For Prelims: Tuberculosis (TB), Mycobacterium tuberculosis, Bacille Calmette-Guerin (BCG), World Health Organisation, Ni-kshay portal, CB-NAAT, TureNat, Bedaquiline, Delamanid, Immuvac, and VPM1002.

For Mains: 1. What is Tuberculosis and discuss the global and Indian efforts to eliminate Tuberculosis.

|

WHOLESALE PRICE INDEX (WPI)

Inflation in India’s wholesale prices rose to a 13-month high of 1.26% in April, from 0.53% in March, owing to an uptick in food inflation and a 1.4% year-on-year rise in fuel and power prices after several months of deflation.

2. What is the Wholesale Price Index(WPI)?

The Wholesale Price Index (WPI) is a measure of the changes in the prices of goods sold and traded in bulk by wholesale businesses to other businesses or retailers. It is one of the key indicators used to measure inflation and economic performance in a country.

WPI tracks the average price changes of goods at the wholesale level, providing insights into inflationary pressures in the economy. It includes various categories of goods such as agricultural products, industrial raw materials, fuel and power, and manufactured goods.

Governments and policymakers use WPI data to monitor inflation trends, formulate monetary and fiscal policies, and assess the overall health of the economy. It serves as a crucial tool for businesses to adjust pricing strategies, forecast costs, and make informed decisions regarding production and investment

3. Importance of WPI

The Wholesale Price Index (WPI) holds several significant roles in economic analysis and policymaking:

- WPI is a key indicator used to measure inflationary pressures in the economy. By tracking changes in the prices of goods at the wholesale level, it provides insights into the direction and magnitude of inflation. This data is crucial for policymakers in formulating monetary and fiscal policies to maintain price stability

- WPI serves as a barometer of economic performance, reflecting changes in production costs, input prices, and overall market conditions. Fluctuations in WPI can indicate shifts in supply and demand dynamics, business confidence, and economic activity levels

- Governments and central banks rely on WPI data to formulate and adjust monetary and fiscal policies. By assessing inflationary trends captured by WPI, policymakers can make informed decisions regarding interest rates, money supply, taxation, and government spending to achieve macroeconomic objectives such as price stability, economic growth, and employment generation

- Businesses utilize WPI as a tool for forecasting production costs and adjusting pricing strategies. By monitoring changes in wholesale prices of goods, companies can anticipate future cost pressures, optimize supply chain management, and make pricing decisions to maintain profitability and competitiveness in the market

- WPI data is also crucial for analyzing trends in international trade. Changes in wholesale prices can affect export competitiveness, import demand, and trade balances. Policymakers use WPI information to assess the impact of exchange rate fluctuations, trade policies, and global economic conditions on domestic industries and trade relations

The Consumer Price Index (CPI) is a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care. It is one of the most widely used indicators for tracking inflation and assessing changes in the cost of living over time.

CPI is calculated by collecting price data for a representative sample of goods and services that are typically purchased by urban consumers. The prices of these items are then aggregated and weighted according to their relative importance in the average consumer's expenditure. The resulting index reflects the average price level experienced by consumers

CPI is used by governments, central banks, businesses, and households for various purposes:

- CPI is primarily used to measure inflation, which is the rate at which the general level of prices for goods and services is rising. By tracking changes in the CPI over time, policymakers can gauge the extent of inflationary pressures in the economy and adjust monetary and fiscal policies accordingly

- Many labour contracts, pension plans, and government benefits are indexed to CPI. This means that payments or wages are adjusted periodically based on changes in the CPI to maintain purchasing power and account for changes in the cost of living

- Central banks often use CPI as a key input in their monetary policy decisions. By targeting a specific inflation rate, central banks aim to achieve price stability and support sustainable economic growth. CPI data helps policymakers assess whether monetary policy actions are effectively controlling inflation

- Investors and financial analysts use CPI data to adjust their investment strategies and financial planning. Understanding inflation trends can help investors anticipate changes in interest rates, bond yields, and stock market performance, which in turn influence investment decisions

- CPI data provides insights into consumer behavior and spending patterns. Changes in the prices of specific goods and services reflected in the CPI can affect consumer preferences, purchasing decisions, and overall economic activity

| Subject | Wholesale Price Index (WPI) | Consumer Price Index (CPI) |

|---|---|---|

| Scope of Goods and Services | Measures changes in prices of goods traded in bulk by wholesalers, including raw materials, intermediate goods, and finished goods. | Tracks changes in prices of goods and services purchased by households for consumption, including food, housing, transportation, etc. |

| Target Audience | Relevant to businesses, policymakers, and analysts involved in production, manufacturing, and trade. | Important for individuals, households, labor unions, and policymakers involved in setting wages, pensions, and social security benefits. |

| Weighting and Composition | Based on a fixed basket of goods and services weighted according to their relative importance in wholesale trade. | Based on a basket of goods and services representative of urban consumer spending patterns. |

| Policy Implications | Changes in WPI affect production costs, supply chain management, and business profitability. Used by policymakers to assess inflation trends and formulate industrial and trade policies. | Changes in CPI directly impact the cost of living for households and influence consumer behavior, purchasing power, and welfare. Used by policymakers to adjust wages, social benefits, and taxation policies. |

|

For Prelims: Consumer Price Index, Wholesale Price Index, Inflation, retail inflation, Producer Pirce Index, National Statistical Office, OPEC+, Crude oil, Kharif season, Monsoon,

For Mains:

1. Analyse the factors contributing to high food inflation in India in recent months. Discuss the impact of high food inflation on the Indian economy and suggest measures to mitigate it. (250 words)

2. Explain the concept of sticky inflation. What are the various factors that contribute to sticky inflation? Discuss the implications of sticky inflation for the Indian economy. (250 words)

|

|

Previous Year Questions

1. With reference to inflation in India, which of the following statements is correct? (UPSC 2015)

A. Controlling the inflation in India is the responsibility of the Government of India only

B. The Reserve Bank of India has no role in controlling the inflation

C. Decreased money circulation helps in controlling the inflation

D. Increased money circulation helps in controlling the inflation

Answer: C

2. With reference to India, consider the following statements: (UPSC 2010)

1. The Wholesale Price Index (WPI) in India is available on a monthly basis only.

2. As compared to Consumer Price Index for Industrial Workers (CPI(IW)), the WPI gives less weight to food articles.

Which of the statements given above is/are correct?

A. 1 only B. 2 only C. Both 1 and 2 D. Neither 1 nor 2

Answer: C

3. Consider the following statements: (UPSC 2020)

1. The weightage of food in Consumer Price Index (CPI) is higher than that in Wholesale Price Index (WPI).

2. The WPI does not capture changes in the prices of services, which CPI does.

3. Reserve Bank of India has now adopted WPI as its key measure of inflation and to decide on changing the key policy rates.

Which of the statements given above is/are correct?

A. 1 and 2 only B. 2 only C. 3 only D. 1, 2 and 3

4. India has experienced persistent and high food inflation in the recent past. What could be the reasons? (UPSC 2011)

1. Due to a gradual switchover to the cultivation of commercial crops, the area under the cultivation of food grains has steadily decreased in the last five years by about 30.

2. As a consequence of increasing incomes, the consumption patterns of the people have undergone a significant change.

3. The food supply chain has structural constraints.

Which of the statements given above are correct?

A. 1 and 2 only B. 2 and 3 only C. 1 and 3 only D. 1, 2 and 3

Answer: B

5. The Public Distribution System, which evolved as a system of management of food and distribution of food grains, was relaunched as _______ Public Distribution System in 1997. (SSC JE EE 2021)

A. Evolved B. Transformed C. Tested D. Targeted

Answer: D

6. Under the Antyodaya Anna Yojana, up to what quantity of rice and wheat can be purchased at a subsidised cost? (FCI AG III 2023)

A. 35 kg B. 40 kg C. 30 kg D. 25 kg E. 50 kg

Answer: A

7. As per the the National Statistical Office (NSO) report released on 7 January 2022, India's Gross domestic product (GDP) is expected to grow at ___________ per cent (in first advance estimates) in the fiscal year 2021-22? (ESIC UDC 2022)

A. 17.6 per cent B. 9.5 per cent C. 11 per cent D. 9.2 per cent E. None of the above

Answer: D

8. The main emphasis of OPEC (Organisation of the Petroleum Exporting Countries) is on which of the following? (UKPSC 2016)

A. The production of petroleum

B. Control over prices of petroleum

C. Both (a) and (b)

D. None of the above

Answer: C

9. In the context of global oil prices, "Brent crude oil" is frequently referred to in the news. What does this term imply? (UPSC 2011)

1. It is a major classification of crude oil.

2. It is sourced from the North Sea.

3. It does not contain sulfur.

Which of the statements given above is/are correct?

A. 2 only B. 1 and 2 only C. 1 and 3 only D. 1, 2 and 3

Answer: B

10. The term 'West Texas Intermediate', sometimes found in news, refers to a grade of (UPSC 2020)

A. Crude oil B. Bullion C. Rare earth elements D. Uranium

Answer: C

11. With reference to the cultivation of Kharif crops in India in the last five years, consider the following statements: (UPSC 2019)

1. Area under rice cultivation is the highest.

2. Area under the cultivation of jowar is more than that of oilseeds.

3. Area of cotton cultivation is more than that of sugarcane.

4. Area under sugarcane cultivation has steadily decreased.

Which of the statements given above are correct?

A. 1 and 3 only B. 2, 3 and 4 only C. 2 and 4 only D. 1, 2, 3 and 4

Answer: A

|